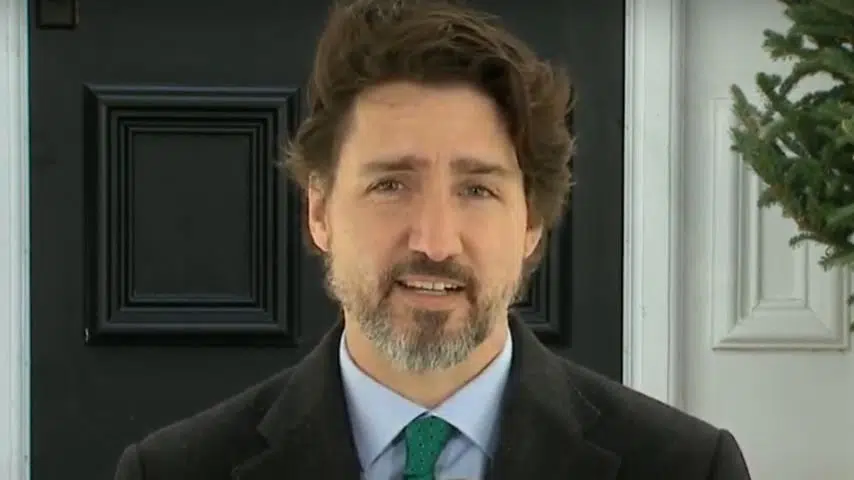

The federal government has introduced a loan program for large businesses intended to help the millions of Canadians that work for them, the prime minister said in his Monday press briefing.

“These are bridge loans, not bailouts,” he said. “Just as we are finding ways to support small- and medium-sized businesses, we’ll provide loans to the largest enterprises to help them weather the storm and protect the millions of jobs they provide across Canada.”

Trudeau said the program, called the Large Employer Emergency Financing Facility (LEEFF), is designed to be a lender of last resort for companies that can’t get enough bridge financing through private-sector lending institutions to remain in business.

“The first [objective] is to avoid bankruptcies,” said Trudeau. “Our purpose is to keep large Canadian companies on their feet and protect the millions of jobs they provide.”

“The objective is not to fix pre-existing insolvencies or restructurings, nor is it to provide low-cost lending to companies that don’t need it.”

The government is placing conditions on the loans, including:

maintaining jobs and investment.

respecting collective union agreements and pension obligations

respecting environmental and climate commitments.

strict limits on dividends, share buybacks and executive compensation.

“To stand strong against tax avoidance and tax evasion,” Trudeau said they will also be requiring companies to share with the government their “complete financial structure” as they submit applications for loans.

Trudeau was asked if oil and gas companies would be eligible because of their contributions to rising greenhouse gas emissions.

“We have seen many oil and gas companies make commitments already around net-zero by 2050, around understanding that we need to do better in terms of reducing emissions both as a country and as a sector,” he said.

“That’s why we’re expecting them to put forward a frame within which they will demonstrate their commitments to reducing emissions and fighting climate change.”

Trudeau didn’t provide details on how they would establish and enforce guidelines around limiting dividend payouts and executive compensation but stressed the government’s resolve to make sure the money supports the people who need it most.

“Canadians expect that if we’re putting public dollars to support financing for companies, that the money goes to support workers…that’s not shareholders through dividends, that’s not executive bonuses,” he said.

“[It’s to ensure] that everything they’re doing is protecting workers, their pensions, their collective bargaining and the continued operation of this company in the country.”

A version of this story was published in Huddle, an Acadia Broadcasting content partner.