Saint John councillors have voted in favour of a pay increase — but the amount they bring home will not change.

New federal rules mean municipal elected officials will no longer be able to claim one-third of their salaries as tax-free as of Jan. 1, 2019.

The move means a Saint John councillor’s after-tax income would drop by around $3,000 a year while the mayor would lose $9,000 a year.

According to a city staff report, the allowance was established in 1946 “to compensate officials who were incurring expenses without being adequately reimbursed.”

City staff are recommending four options:

Option 1: Compensating salary increase (full)

Option 2: Compensating salary increase (partial)

Option 3: Expanded expense policies

Option 4: No action— Brad Perry (@BradMPerry) November 6, 2018

Coun. Blake Armstrong, who voted in favour of the increase at Monday night’s meeting, said the pay increase will simply keep their after-tax income the same.

“I have no problem defending taking money for a job, when we’re making multimillion-dollar decisions, because someone in Ottawa decided to cut the rate,” Armstrong said. “We didn’t decide.”

Five other councillors also voted in favour of the increase, including David Merrithew, who chairs the city’s finance committee.

Merrithew said it is not an unreasonable request for anyone if their pay “was reduced by a substantial amount because of a third-party action”.

Coun. John MacKenzie says he agrees the tax changes will make things more transparent, but he doesn’t think council should have to take a pay cut. He says most councils are compensating the full salary increase, which he calls staying at the status quo.

— Brad Perry (@BradMPerry) November 6, 2018

But not every councillor agreed with the pay bump, including Greg Norton, who said he cannot accept a pay hike right now.

“For me, I’ve gotta make it more affordable for the folks that we serve by either reducing their water rates or the tax rate here, bringing greater value to their dollars,” he said.

Deputy Mayor Shirley McAlary and Coun. Gary Sullivan also voted against the motion and said they feel uncomfortable changing their own remuneration.

The adjustment will cost taxpayers around $40,000 a year, which Armstrong said is a small amount in the overall budget.

—–

Story by Brad Perry

Twitter: @BradMPerry

Email: perry.brad@radioabl.ca

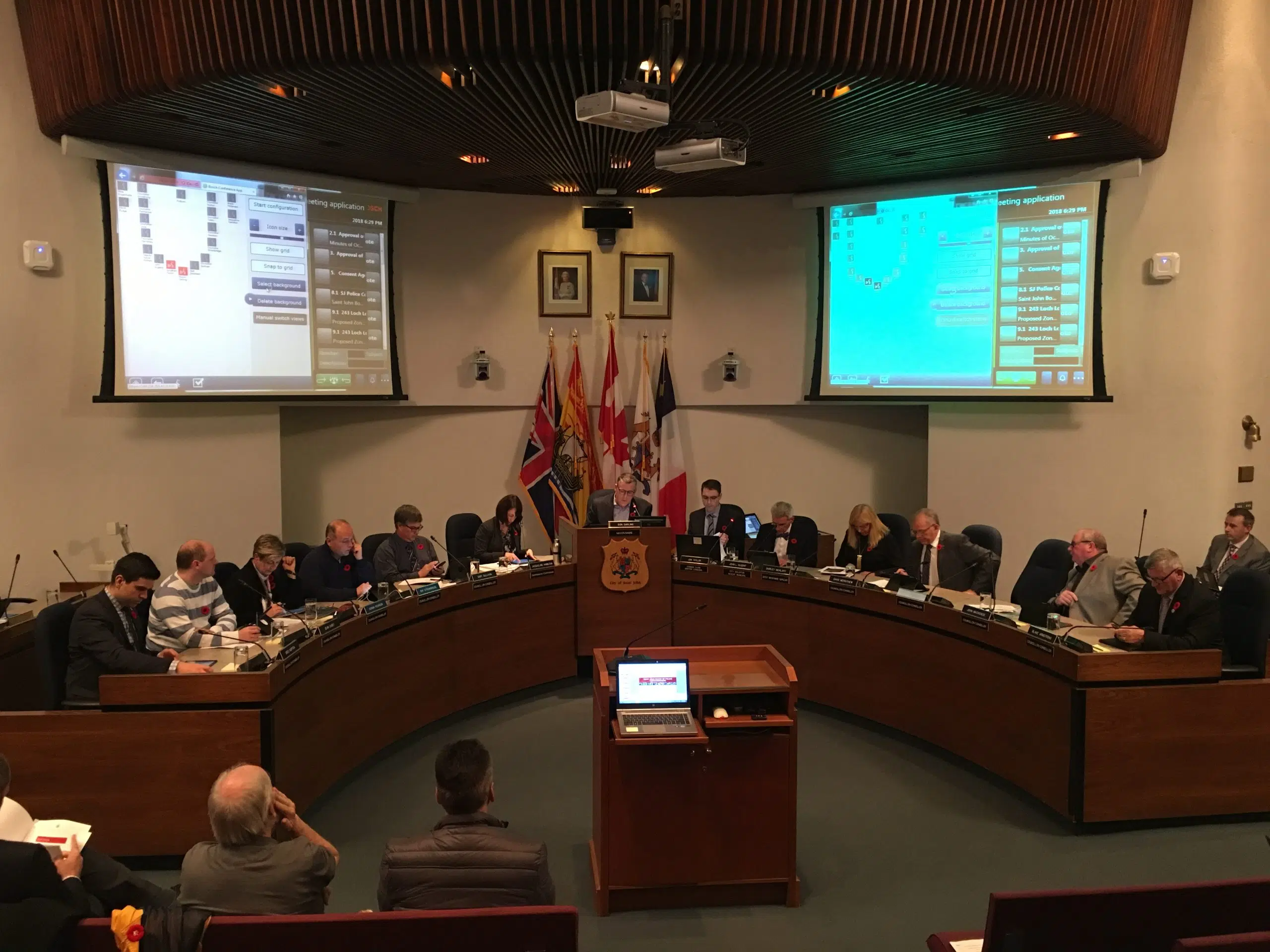

(Photo: Brad Perry/Acadia News)